Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

How would you feel if you found out that US income inequality had not risen over the past 60 years; the rich had not taken the lion’s share of economic growth since the 1980s; and the poorest half of US society had about the same share of total income in 2020 as they had in 1960?

I suspect many, like me, would feel pleasure tinged with scepticism. Happiness because it suggests the world’s most powerful economy was producing fairer outcomes and disbelief because the conjectures run counter to almost everything we have been told about US society.

These are not just hypothetical questions; the results lie at the centre of an analysis by Gerald Auten and David Splinter — officials, respectively, at the US Treasury’s Office of Tax Analysis and the US Congress Joint Committee on Taxation. Their paper has this month been accepted for publication in a top peer-reviewed academic journal.

It would be fair to call Auten and Splinter tax and data nerds. Their work highlights deep problems stemming from naive analysis of administrative data — in this case tax records. While macroeconomic analysis is currently suffering a crisis of survey response biases, this highlights a methodological crisis in microeconomic analysis.

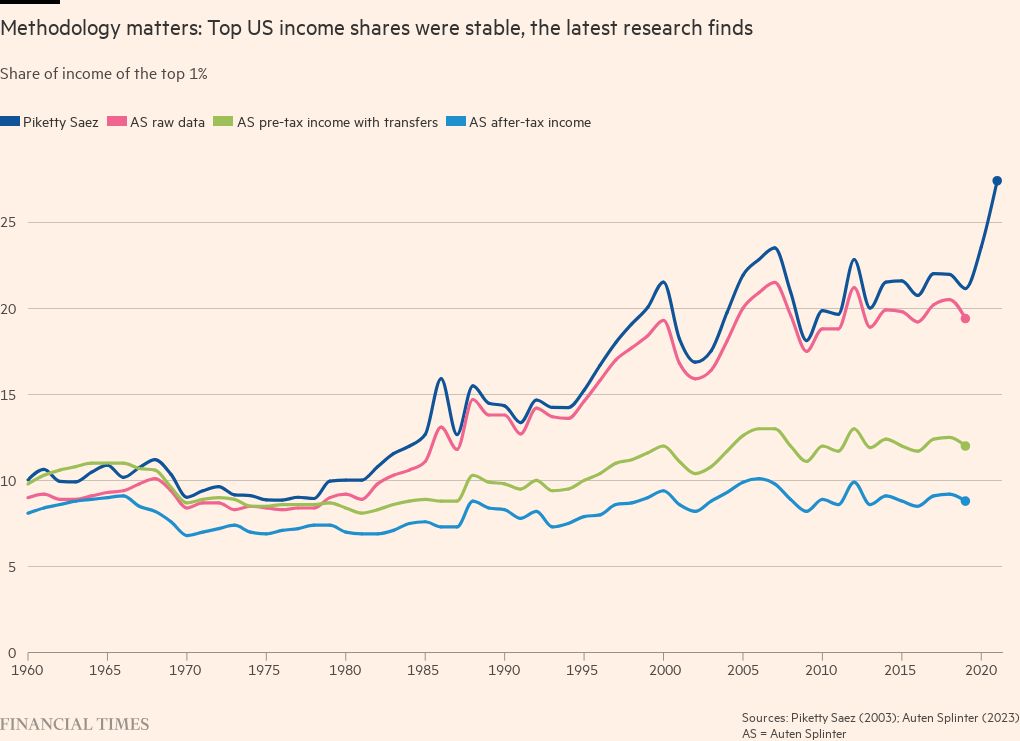

The main protagonists in US tax record research have been Thomas Piketty and Emmanuel Saez, who popularised the findings that the top 1 per cent share of income roughly doubled from 8 per cent in the 1980s and hit 27 per cent by 2021. Later work with Gabriel Zucman moderated these findings a little, but still left a picture of the rich running off with the spoils.

Auten and Splinter document how these economists were not sufficiently careful with their research, alleging the earlier work was “not robust” in the face of evidence about how people fill in tax returns. The beauty of their analysis is that they start with the results in the raw data and then document the myriad adjustments that are needed to say something about society.

Some of the methodological choices and disputes are eye-opening. The earlier work, for example, ends up with significantly more than 1 per cent of US people in the top 1 per cent because marriage rates became much higher among the rich than the poor. Other big differences are that Auten and Splinter say (reasonably) that changes in US taxation rules in 1986, which made the rich more likely to pay out money in dividends from companies, did not represent an increase in the resources held by the rich, just a change in behaviour.

They also highlight the importance of not counting people rolling savings from one pension pot to another as income and demonstrate that corporate tax evasion among the self-employed is not concentrated among the super-rich. They estimate this from Internal Revenue Service audits rather than assuming under-reported income matches that of reported income.

The upshot is that they find before-tax income inequality did rise, with the top 1 per cent share rising from 9.8 per cent to 12 per cent between 1960 and 2019. This was, however, offset by a more progressive transfer system, particularly in health benefits for US households, with the top 1 per cent’s share of after-tax income pretty stable over 60 years.

One conclusion is that methodology matters in such research. A more profound one is that if income inequality has not risen, we have been asking the wrong questions about US society. Instead of asking how to curb the power of the super-rich, perhaps there are better questions. For example, why has a rise in redistribution been so ineffective in solving the US societal ills? And do we want so much of redistribution to be undertaken through healthcare rather than providing poorer households with more money?

Leave a Reply