Stay informed with free updates

Simply sign up to the US banks myFT Digest — delivered directly to your inbox.

The biggest US banks have warned their investors that they will eventually have to bow to customer pressure and offer much higher rates to depositors, cutting into the higher profits generated off the back of the Federal Reserve’s interest rate rises.

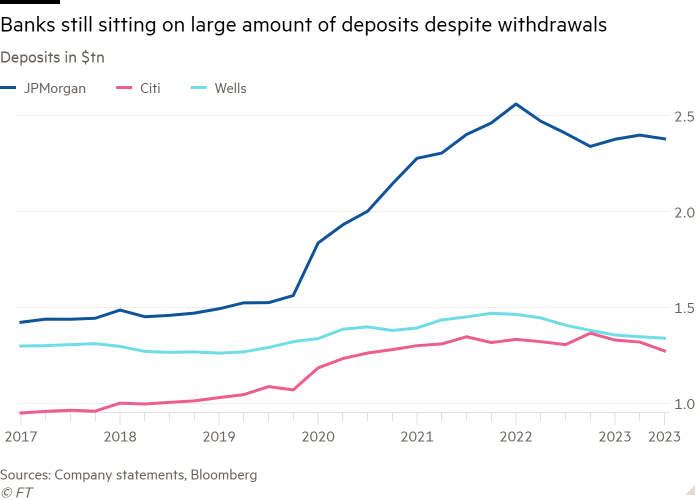

Big consumer banks like JPMorgan Chase and Wells Fargo have been able to charge more for loans as the Fed has lifted benchmark interest rates to a 22-year high, without having to pass on commensurately higher savings rates to depositors, particularly retail customers.

In third-quarter earnings on Friday, both banks, along with Citigroup, reported year-on-year gains from their lending businesses which were ahead of analysts’ forecasts. JPMorgan, the largest US bank, and Wells lifted their outlooks for lending income in 2023.

“The markets have been expecting some dramatic squeeze on the cost of consumer deposits [for banks] from the rate movement. And that just doesn’t seem to be happening,” said Chris Kotowski, banking analyst at Oppenheimer.

Large banks benefit from their perceived safety, which comes from their size and their designation by regulators that they are systemically important to the US economy.

They also took on tens of billions of dollars of deposits during the pandemic. This has reduced pressure to retain customers, some of whom have moved funds into higher-yielding areas such as money market funds.

Thousands of smaller regional bankers in the US have struggled to retain deposits without offering to pay customers significantly more.

JPMorgan chief executive Jamie Dimon said he disagreed with some of his top executives — finance chief Jeremy Barnum, and co-CEOs of consumer and community banking Jennifer Piepszak and Marianne Lake — over when competitive pressures may force the bank to offer higher rates to savers.

“We have a big debate inside this company. I personally think it will happen a little bit sooner than Jenn and Marianne and Jeremy,” Dimon said on a call with reporters, without elaborating.

Barnum admitted that the need to increase rates for depositors had been slower than “previously assumed”.

“We’re precisely not predicting when it’s going to happen,” he said. “We’re going to compete to keep customers. If that means repricing deposits we’re going to do it but we’re going to do it as a function of the competitive environment.”

Wells chief financial officer Michael Santomassimo said the bank, the fourth-largest in the US by assets, had been “pleasantly surprised” that competitive pressure to lift interest rates for deposits had not progressed as fast as expected but warned that “at some point, it will”.

“There’s still a lot of uncertainty out there in terms of how the path of both the deposits and pricing will shape up,” Santomassimo told analysts.

Banks that cater to more corporate clients, who are more likely to move their money in search of higher rates, have had to increase their rates more in order to hold on to deposits.

Citi, where two-thirds of its deposits are held in corporate accounts, is paying an average rate of 3.4 per cent on interest bearing deposits, up from 1.2 per cent a year ago. By comparison, JPMorgan is paying an average of 2.53 per cent on its interest-bearing deposits, up from 0.73 per cent a year ago.

Citi CFO Mark Mason told analysts he thought his bank, particularly in the US, had probably already hit the “terminal rate”, or the peak of what it would have to pay in interest in order to keep depositors.

In its battle to combat inflation, the Fed has lifted the federal funds rate to a range of between 5.25 per cent and 5.5 per cent. Some investors are betting that the central bank will lift rates one more time this year. But others believe it will keep them on hold and potentially leave higher rates in place for a lengthy period of time.

Executives at money manager BlackRock expect more savers will move cash out of bank deposits and into money market mutual funds and bonds once they are convinced the Fed has stopped raising rates.

“We expect that investors will begin redeploying assets once there is conviction in the terminal rate,” chief executive Larry Fink told analysts on a call for its third-quarter results on Friday.

The bumper bank profits were another sign that the US economy was continuing to defy predictions made either this year that a recession was imminent. Credit card transactions rose 8 per cent in the quarter at Citigroup. Both JPMorgan and Wells Fargo lowered, from the previous quarter, the amount of money they put away for potential loan losses.

“The unemployment rate is still at 3.8 per cent,” Barnum said. “Fundamentally, the biggest single driver of consumer credit is the labour market.”

Additional reporting by Brooke Masters

Leave a Reply